Calling Traders and Investors...

Finally, A Trading Approach That Doesn’t

Depend on Predicting Market Direction

(Why even attempt to predict the unpredictable?)

You're about to learn...

How traders and investors apply our systematic, rules-based strategy without requiring prediction or constant monitoring

What it takes to follow a consistent, probability-focused framework designed to support disciplined, data-driven trading

Which structured approach is employed to handle orders, adjustments, and risk based on time decay and volatility without the need for expertise in options

Why systematic options selling works and how automation can support more consistent trading behavior

What You Get

SFAD Playbook (setup, strikes, sizing, timing)

Printable Checklist (pre-trade & management)

Roll & Risk Rules (exact triggers and actions)

Alert Templates & broker workflow guidance

Performance Tracking Sheet (log & review)

Updates included as the process improves

STILL NOT SURE?

Frequently Asked Questions

We understand that you may have questions about Scalping From A Distance and Lock and Roll Trading.

Q: How much time does SFAD take?

A: Through Lock and Roll automation, SFAD trades on its own, following your parameter-based rules. It's always a good idea to check on your account, of course, but the system will trade without requiring any time from you.

Q: Is SFAD risky?

A: All trading involves risk, and naked options have theoretically unlimited risk. But the Lock and Roll trading platform monitors your positions 24/7/365 using your rules, sizing, and parameters to control risk. Losses can and will occur, but the software is designed to keep them manageable and infrequent compared to gains.

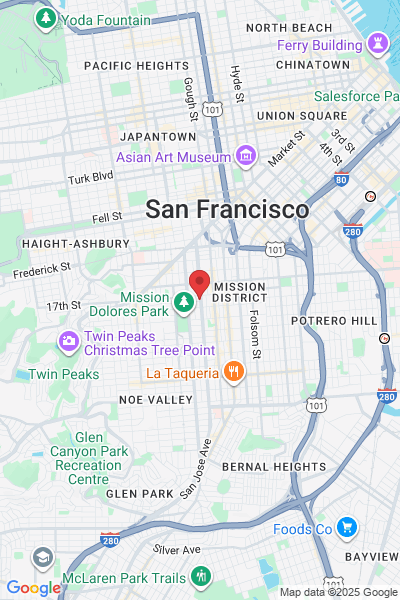

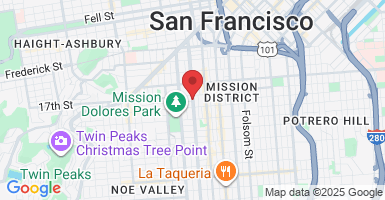

Q: Which instruments can I trade?

A: The Lock and Roll trading platform currently uses the TastyTrade API, so any futures contracts available are fair game. We currently load price data for /CL, /GC, /ES, /NQ, and a few others. If you want to trade something that is not listed, please get in touch. We will happily accommodate you.

Q: Do I need to predict price?

A: No. We value rules and position management over prediction. No one knows where the market is going to go, so we play a different game where we win without attempting to predict the future.

Q: Does SFAD replace my current system?

A: Not necessarily. Many traders will augment their existing strategies with SFAD to diversify their income streams.

Q: Is this financial advice?

A: No. This is educational process guidance. You're responsible for your own decisions and results.

The Financial Solution

You Deserve is Just a Click Away

We make it easier to access the funds you need, when you need them. Our lending services are designed to be clear, flexible, and reliable — so you can move forward with confidence.

45k+

Loans Approved

Thousands have trusted us to support their financial goals. With over 45,000 loans approved, our experience speaks for itself.

Our Expertise

With years of experience in lending, we understand how to match the right solution to each client's needs. Our team is here to guide you through every step with clarity and care.

Trusted lending advice, built on experience.

45K+

Loans Approved

15+

Years of Experience

98%

Client Satisfaction

24h

Average Approval Time

Our Services

Services Designed to Support Your Goals

Personal Loans

Flexible financing for life’s planned and unexpected expenses. Whether it's medical bills, home improvements, or travel, we make borrowing straightforward.

Fast, flexible funding.

Business Loans

Support for startups and established businesses alike. We offer funding solutions that help you manage operations, invest in growth, or handle cash flow.

Capital that fits.

Debt Consolidation

Combine multiple payments into one manageable loan with better terms. It's a practical way to take control of your finances and reduce stress.

Simplify your payments.

Focused on funding what matters most — your future.

Our Mission

Empowering Your Financial Journey

We are committed to providing clear, accessible, and responsible lending solutions. Our goal is to help individuals and businesses achieve their financial objectives, one step at a time.

By offering personalized service and expert guidance, we aim to build long-term relationships, not just transactions. Our mission is to make your financial success our top priority.

Customers Focused

We focus on understanding your unique needs, providing solutions that work best for you.

Transparent Funding

Honesty and clarity guide every decision we make, ensuring trust in every interaction.

Why Choose Us

What Sets Us Apart?

Our mission is to make financial solutions simple and accessible. With a focus on customer satisfaction, we provide flexible, clear, and reliable lending options that meet your unique needs. Whether you're managing personal expenses or growing a business, we're here to offer support with a commitment to transparency and efficiency.

⇨ Tailored Options: Customized lending to fit your needs.

⇨ Fast Processing: Quick approvals and easy application.

⇨ Clear Terms: No hidden fees or fine print.

⇨ Expert Guidance: Support from experienced professionals.

FAQS

Frequently Asked Questions

What types of loans do you offer?

We offer personal loans, business loans, and debt consolidation options, each tailored to meet your specific needs. Our goal is to provide flexible solutions that suit various financial situations.

How do I apply for a loan?

You can apply easily through our secure online application form. Simply provide your details, and our team will review your application and get back to you with a decision.

What are the loan requirements?

We require basic personal information, proof of income, and identification. Specific requirements may vary depending on the loan type, but we make the process clear and simple.

How long does it take to get approved?

Approval times vary, but most loans are approved within 24 hours. We aim to process applications quickly and keep you informed throughout the process.

What is the interest rate on your loans?

Interest rates depend on the type of loan and your financial profile. We strive to offer competitive rates and provide full transparency with no hidden fees.

Can I pay off my loan early?

Yes, you can pay off your loan early without penalty. We believe in giving you the flexibility to manage your finances as you see fit.

What is the interest rate range?

Repayment options are simple and flexible. You can set up automatic payments or pay manually based on your loan terms.

What if I can’t make a payment on time?

If you're unable to make a payment, reach out to us as soon as possible. We can discuss alternative arrangements to ensure your loan stays on track.

Our Process

Your Path to Financial Success

#1

Apply Online

Submit a quick, secure application from anywhere.

#2

Review & Approval

We assess your application and approve it promptly.

#3

Receive Funds

Get your funds quickly and easily. This is what it is.

Testimonials

We Have Solutions For Everyone

"

"Working with this team has been an absolute game-changer for me. I was struggling to find a loan that fit my needs, and other lenders only made the process more complicated. But from the very beginning, they made everything easy to understand. The application was quick, and I was approved in no time."

John D.

satisfied client

@brooksim1

Pricing Plans

Watch Our Pricing Plans

Starter Package

For Studens

Loan Amount: Up to $10,000

Duration: 12 Months

Interest Rate: 5%

Monthly Reports

$99

Per Month

Premium Package

For Individual Businesses

Loan Amount: Up to $50,000

Duration: 36 Months

Interest Rate: 3.5%

Monthly Reports

$199

Per Month

Business Package

For Larger Businesses

Loan Amount: Up to $80,000

Duration: 50 Months

Interest Rate: 2%

Monthly Reports

$299

Per Month

This webinar is provided for educational purposes only. The content shared is intended to improve general knowledge of financial markets and trading concepts. It does not provide investment, financial, tax, or legal advice, and should not be construed as a recommendation to buy, sell, or trade any financial instrument. Past performance is not indicative of future results. You should seek advice from a licensed financial advisor before making investment decisions. Participation in this webinar does not create any client, advisory, or fiduciary relationship.

Copyright © 2025 Grey Matter, LLC

All Rights Reserved.